Effect of historical events on the Stock Market

Data Analysis:

Sensex-BSE

Data of the historical events that happened in the year 1996 was collected and their effects on the Sensex are analyzed.

FTSE100 Index

Data of the historical events that happened in the

Observations:

Sensex-BSE

Ø There were many up and downs in the stock market in the year 1996.

Ø Due to reduction in CRR again the market become bullish in the month of April.

Ø In the month of May,Atal Bihari Vajpayee became Prime Minister,stock market became bearish while within 15 days again HD Deve Gowda became PM and stock prices started rising.

Ø In the month of October minimum lending rate was reduced from 17% to 16.5%,so falling stock prices again rose.

Ø Again in the month of November CRR reduced,stock market again became bullish for sometime.

Effect of historical events on the SENSEX for the year 1996

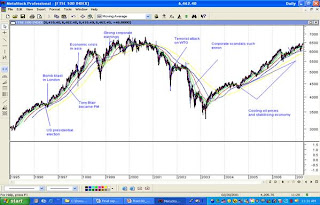

FTSE100 Index

Ø Due to the bomb blast in

Ø During the period of US-presidential elections there were many fluctuations in the market.

Ø When Tony Blair became Prime Minister of Britain, the stangnat stock market prices started rising and again stock market became bullish.

Ø In October 1997, due to economic crisis in

Ø The financial results of various companies in the month of February 1999 showed strong earnings, due to which stock market gained investor confidence and stock prices rose.

Ø After the release of Consumer confidence data in the

Ø The year 2001 was worst for

Ø Again in 2002 also,the situation become worst.The corporate scandals such as enron and world com,the forecast of poor corporate earnings were responsible for the downturn of the market.Again the market fell upto 3500 mark.

Ø But again from 2004,the stock market started recovering due to the stabilizing economy.

Effect of historical events on the FTSE 100 Index

No comments:

Post a Comment